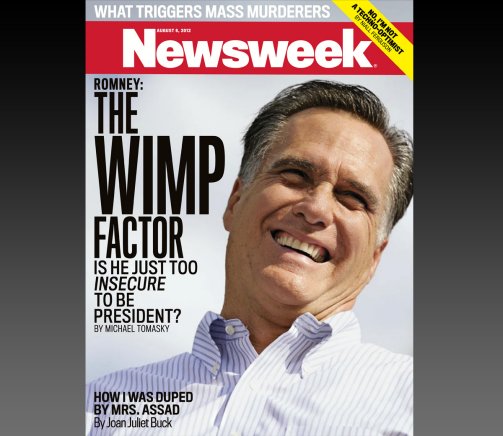

Released at 3 p.m.EST via www.mittromney.com/disclosure this move fulfills a promise Romney made earlier in the 2012 presidential campaign. But it was unlikely to quiet Democratic criticisms that Romney has failed to live up to a standard set by his father, former Michigan Governor George Romney, who released 12 years of tax returns when he ran for president in 1968.

Releasing information on a Friday afternoon is traditionally a way to reduce the amount of media exposure. And at the moment the ROmney camp is still on damage control mode following the release of the private 47% statements.

“You’ll see my income, how much taxes I’ve paid, how much I’ve paid to charity,” Romney said. “I pay all the taxes that are legally required and not a dollar more. I don’t think you want someone as the candidate for president who pays more taxes than he owes.”

Republican presidential nominee Mitt Romney earned $13.69 million in 2011, mostly income from his investments, and paid $1.9 million in taxes for an effective tax rate of 14.1 percent, his campaign announced Friday.

The Romneys only claimed a tax deduction for $2.25 million of those charitable contributions to engineer a higher tax rate than they otherwise would have paid. This move was to “conform” to the candidate’s statement in August that he paid a federal income tax rate of at least 13 percent of his income in each of the last 10 years, Brad Malt, Romney’s trustee, said in a statement released by the campaign.

At a Republican presidential debate in January, on the same night he released his 2010 tax returns, Romney scoffed at the notion that he would pay more taxes than he is legally required.